Annual Financial Reporting

The Auditor of State is responsible for ensuring that local public offices file their annual financial reports as required by the Ohio Revised Code (ORC) and Ohio Administrative Code (OAC).

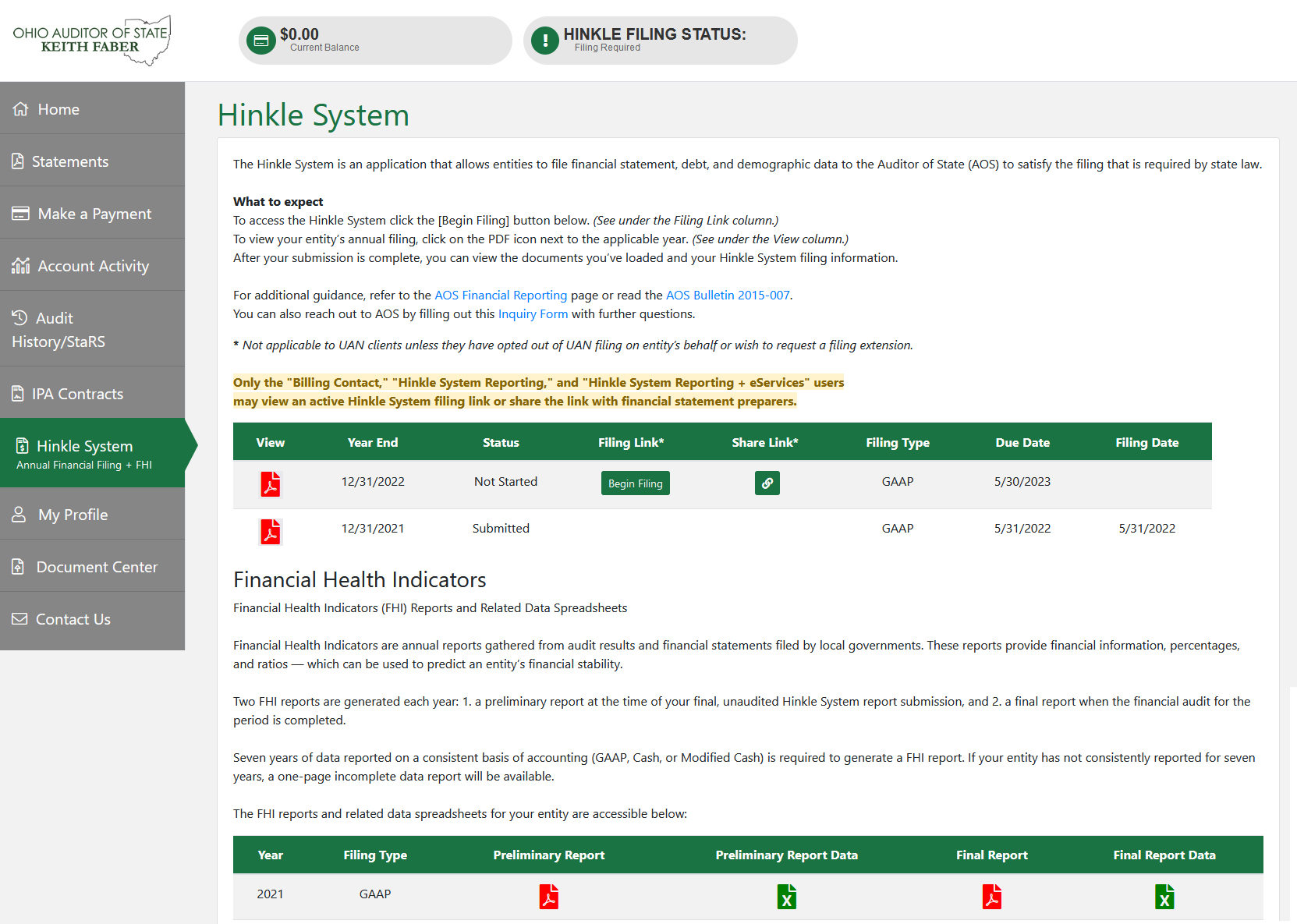

Hinkle Annual Financial Data Reporting System

The Hinkle System is an application developed by the Auditor of State's office to facilitate filing of certain financial statement, debt, and demographic data to the AOS, satisfying the filing requirements of the ORC and OAC. The Hinkle System increases uniformity in financial reporting, generates the statutory reports for the governor and general assembly required by ORC §117.38, and provides users of this information improved access and functionality.

All entities required to file annually with the Auditor of State must file via the Hinkle System).

All entities required to file annually with the Auditor of State must file via the Hinkle System. To access the Hinkle System, log into your entity’s eServices account. This will be available to the entity’s fiscal officer/designated contact after the end of the reporting period. Login Now

Once you have logged in, look for "Hinkle System" in the left menu, then click the [Begin Filing] button under the Filing Link column.

Note: The “Share Link” can be used to share the filing link with a GAAP or other financial statement preparer. Only the entity’s “Billing Contact” and/or the “Hinkle System Reporting” or “Hinkle System Reporting + eServices” contact may access the filing link or share the link with others.

For most UAN clients, the entity's required filing via the Hinkle System will be part of their year-end UAN reporting.

Note: If a UAN entity is statutorily mandated to report on a GAAP accounting basis, it will automatically be opted-out of UAN filing on its behalf.

If a UAN entity is a non-governmental, not-for-profit entity; did not maintain records in UAN for the entire reporting period; or chooses to report on a basis of accounting for which UAN cannot generate financial statements, the entity should submit a request to opt out of UAN filing. This request can be made by logging into the entity’s AOS eServices account to access the entity’s Hinkle System link. Once the opt-out is approved by the AOS, the UAN entity will receive an “override password” to enter when submitting its annual financial report (AFR) to UAN; therefore, the opt-out must be approved before the entity submits its AFR to UAN.

A waiver from required electronic filing may be requested for limited circumstances. If a non-UAN, small government entity is unable to file electronically, the Electronic Filing Waiver Request for Small Governments form should be completed and submitted for consideration. Waivers may be granted for one financial reporting year only. A new request must be submitted for each annual financial reporting period.

The AOS will consider granting an extension when the circumstances listed in AOS Bulletin 2015-007 exist or have occurred. The request for extension should be submitted to the AOS via the Hinkle System no later than the deadline for filing the annual financial report.

Refer to the Hinkle System Extension Request Quick Guide.pdf for help. Extension requests submitted by other methods will not be accepted.

For further guidance, refer to Auditor of State Bulletin 2015-007

For additional questions, you can fill out the Audit Inquiry Form

Guidelines

Ohio laws, financial statements, and accounting guidelines encompass a range of rules and regulations that govern financial reporting and accounting practices in the state of Ohio. Below are some key guidelines and resources that relate to these areas

Ohio law requires local public offices to file their annual financial reports with the Auditor of State (AOS).

- Entities filing on a GAAP basis have 150 days following the end of the fiscal year to submit their financial reports to the AOS in accordance with ORC §117.38.

- Other entities required to file and GAAP-mandated entities choosing to not file on a GAAP basis, have 60 days following fiscal year-end to complete their submission in accordance with ORC §117.38.

Community improvement corporations, including economic development corporations and county land reutilization corporations established under ORC §1724.05, and development corporations established under ORC §1726.11 must file their financial reports to the AOS within 120 days of their fiscal year-end.

Universities and colleges subject to ORC §3345.72 and/or OAC 126:3-1-01(A)(2)(a) must file their financial statements no later than October 31 of each year.

Per ORC §991.06, the Ohio Expositions Commission must file its financial statements on or before September 30 of each year.

- Counties, Cities and School Districts, including Educational Service Centers and Community Schools and Government Insurance Pools required by OAC 117-2-03(B).

- Community Improvement Corporations, including Economic Development Corporations and County Land Reutilization Corporations required by ORC §1724.05.

- Development Corporations required by ORC §1726.11.

- Universities and Colleges required by OAC 126:3-1-01(A)(2)(a).

The required components of the financial report will vary by entity type and basis of accounting. Consider the descriptions below when compiling your annual financial report.

Governmental Entities (including governmental nonprofit entities) filing GAAP, OCBOA Cash, or OCBOA Modified Cash basis:

- Management’s Discussion & Analysis (required for GAAP; optional for OCBOA Cash & OCBOA Modified Cash)

- Basic Financial Statements

- Governmentwide Financial Statements

- Fund Financial Statements *

- Notes to the Basic Financial Statements

- Any Other Required Supplementary Information (RSI) (GAAP only)

Nongovernmental Nonprofit Entities filing GAAP, OCBOA Cash, or OCBOA Modified Cash basis:

- Basic Financial Statements

- Statement of Financial Position

- Statement of Activities

(also known as Statement of Changes in Net Assets)

- Statement of Functional Expenses

(If applicable, FASB ASC 958-720-45-15 requires all nonprofit organizations to present an analysis of expenses by both nature and function in one location. The location can be in one of three places: as a separate statement — the statement of functional expenses; as a schedule in the notes to the financial statements; or on the face of the statement of activities, most likely as line items of natural expenses within functional classifications)

- Statement of Cash Flows (GAAP only)

- Notes to the Financial Statements

- Any Other RSI (GAAP only)

Regulatory Cash Basis Entities (commonly referred to as "AOS basis"):

- Basic Financial Statements

- Statement(s), or Combined Statement(s), of Receipts, Disbursements, and Changes in Fund Balances — Governmental, Proprietary, and Fiduciary, as applicable *

- Notes to the Basic Financial Statements

* Effective with implementation of GASB 84, fund statements (GAAP, OCBOA Cash, or Modified Cash) will include a Statement of Fiduciary Net Position and a Statement of Changes in Fiduciary Net Position. Regulatory Cash Basis entities will be required to include a Combined Statement of Additions, Deductions, and Changes in Fund Balances — All Fiduciary Funds (if applicable) beginning with financial statements ending 12/31/2020.

References

References and additional guides for financial reporting serve as essential tools for ensuring accuracy, compliance, and clarity in financial statements. These additional resources provide detailed instructions, standards, and best practices for preparing and presenting financial information.

Specific Entity Type Quick Guides

- Cities & Counties.pdf — Last updated July 2023

- School Districts.pdf — Last updated July 2023

- Community Schools.pdf — Last updated Aug. 2023

- Libraries.pdf — Last updated Sept. 2023

- Townships.pdf — Last updated Feb. 2024

- Villages.pdf — Last updated Feb. 2024

All other entities, just uploading files:

- All Other Entities.pdf — Last updated Feb. 2024

Other Guides

- Filing Extension Requests.pdf — Last updated July 2023

- How to create, merge, and resize a PDF.pdf — Last updated July 2023

- Hinkle System FAQs.pdf — Last updated July 2023

-

Webinar: Preparing notes for filing

- Course Handout.pdf – Notes for the Financial Statements for Small, Non-GAAP Entities

For additional questions, you can fill out the Audit Inquiry Form

Electronic Filing Waiver Request for Small Governments.pdf — last modified 2015

Alternate Hinkle System Financial Statement Disclosure Report.pdf

– Frequently Asked Questions.pdf

For additional questions, you can fill out the Audit Inquiry Form